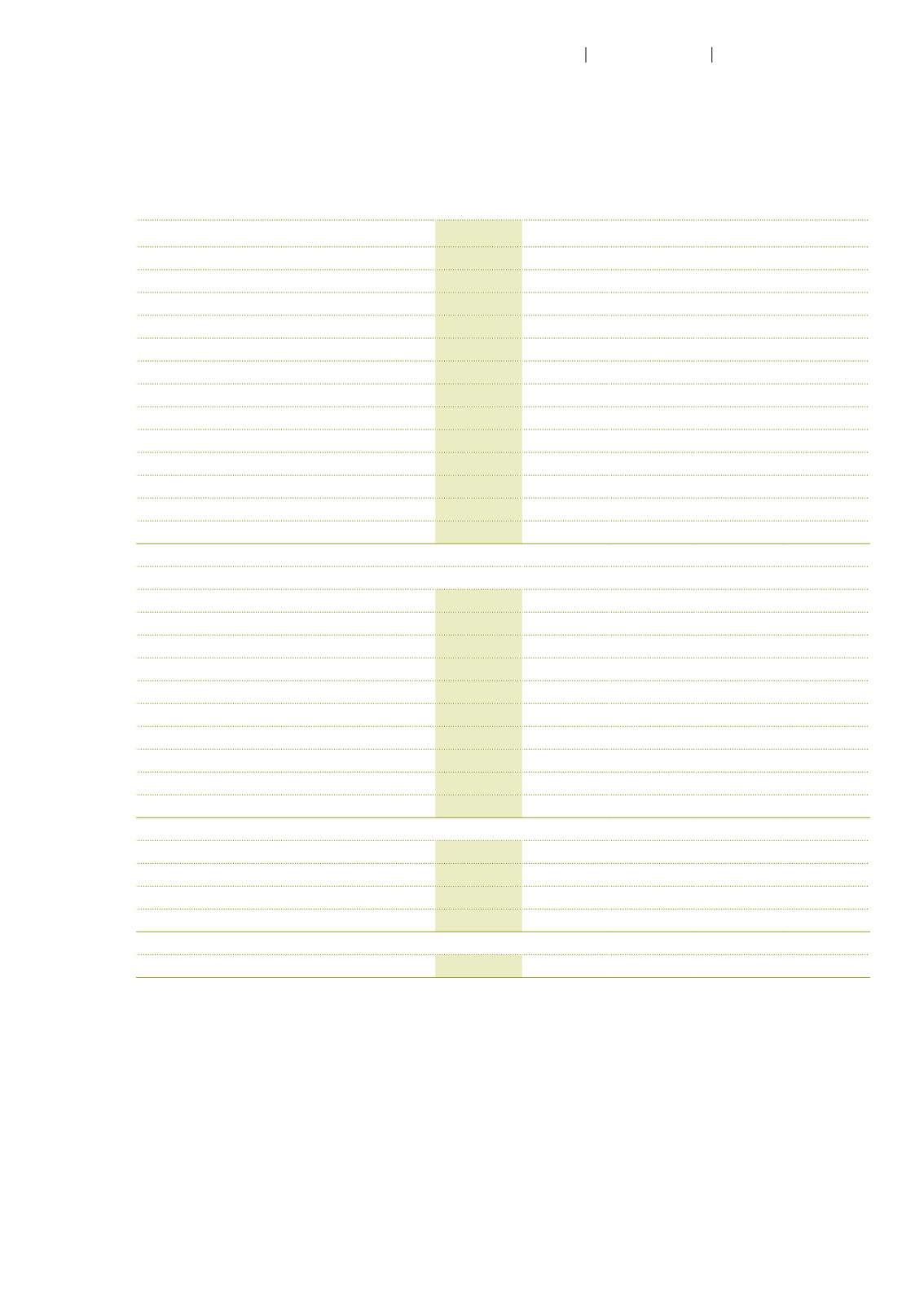

Review 2011–2015

Consolidated income statement

CHF million

2015

2014

1

2013

2012

2011

Net sales

2 085.9 1 954.7 2 053.3 1 940.9 1 682.4

BG Europe

833.2

803.3

901.6

901.2

888.0

BG North America

977.9

882.7

892.4

800.0

571.3

BG Asia

180.9

145.3

128.3

101.4

91.8

BG SAMEA

2

94.3

123.9

138.4

144.7

140.6

EBITDA

191.5

201.6

184.3

146.4

104.2

as a % of net sales

9.2% 10.3% 9.0% 7.5% 6.2%

EBIT

126.5

135.1

79.2

77.3

34.9

as a % of net sales

6.1% 6.9% 3.9% 4.0% 2.1%

Net profit

68.7

102.8

36.2

29.6

2.3

as a % of net sales

3.3% 5.3% 1.8% 1.5% 0.1%

Return on net assets in % (RONA)

12.7% 20.3% 10.3%

10% 4.1%

Return on equity in % (ROE)

17.4% 29.6% 12.5% 11.1% 0.9%

Consolidated balance sheet at December 31

Non-current assets

553.6

536.2

440.7

434.4

417.0

Current assets

561.1

563.0

549.9

517.5

566.2

Equity attributable to shareholders of AUTN

301.3

303.5

232.9

213.2

200.4

Equity attributable to non-controlling interests

96.2

89.0

69.1

62.3

56.4

Total shareholders’ equity

397.5

392.5

302.0

275.5

256.8

Non-current liabilities

284.8

276.8

234.9

237.0

228.9

Current liabilities

432.3

430.0

453.8

439.4

497.5

Total assets

1 114.7 1 099.3

990.6

951.9

983.2

Net debt

105.4

53.9

75.0

123.0

154.8

Shareholders’ equity in % of total assets

35.7% 35.7% 30.5% 28.9% 26.1%

Consolidated statement of cash flows

Cash flows from operating activities

111.7

138.2

165.7

114.9

35.6

Cash flows used in investing activities

–123.1

–108.8

–98.6

–66.8

–82.5

Cash flows used in financing activities

–43.5

–15.0

–20.7

–36.4

–10.6

Employees at December 31

3

11 423

10 681

10 816

10 799

10 424

1

Restated.

2

Including South America, Middle East and Africa.

3

Full-time equivalents including temporary employees but excluding apprentices.

119

Autoneum Financial Report 2015

Review 2011–2015