Foreign exchange risk

Due to the global nature of its activities, the Group is exposed to foreign exchange risk. Foreign

exchange risk arises from investments in foreign subsidiaries (translation risk) as well as from

transactions and financial assets or financial liabilities that are denominated in a currency other than

the functional currency of a legal unit (transaction risk). In order to hedge transaction risk that

cannot be eliminated through offsetting transactions in the same foreign currency (natural hedging),

subsidiaries may use forward contracts, which are usually traded with banks via Group Treasury.

The transaction risk from foreign currencies is monitored periodically.

The subsidiaries’ cash holdings with banks are denominated mostly in the functional currency of

the subsidiary. The majority of the business transacted in Autoneum’s subsidiaries is also in their

functional currency. At the reporting date, the Group held financial instruments which were denomi-

nated in currencies other than the functional currency of the respective Group company as follows:

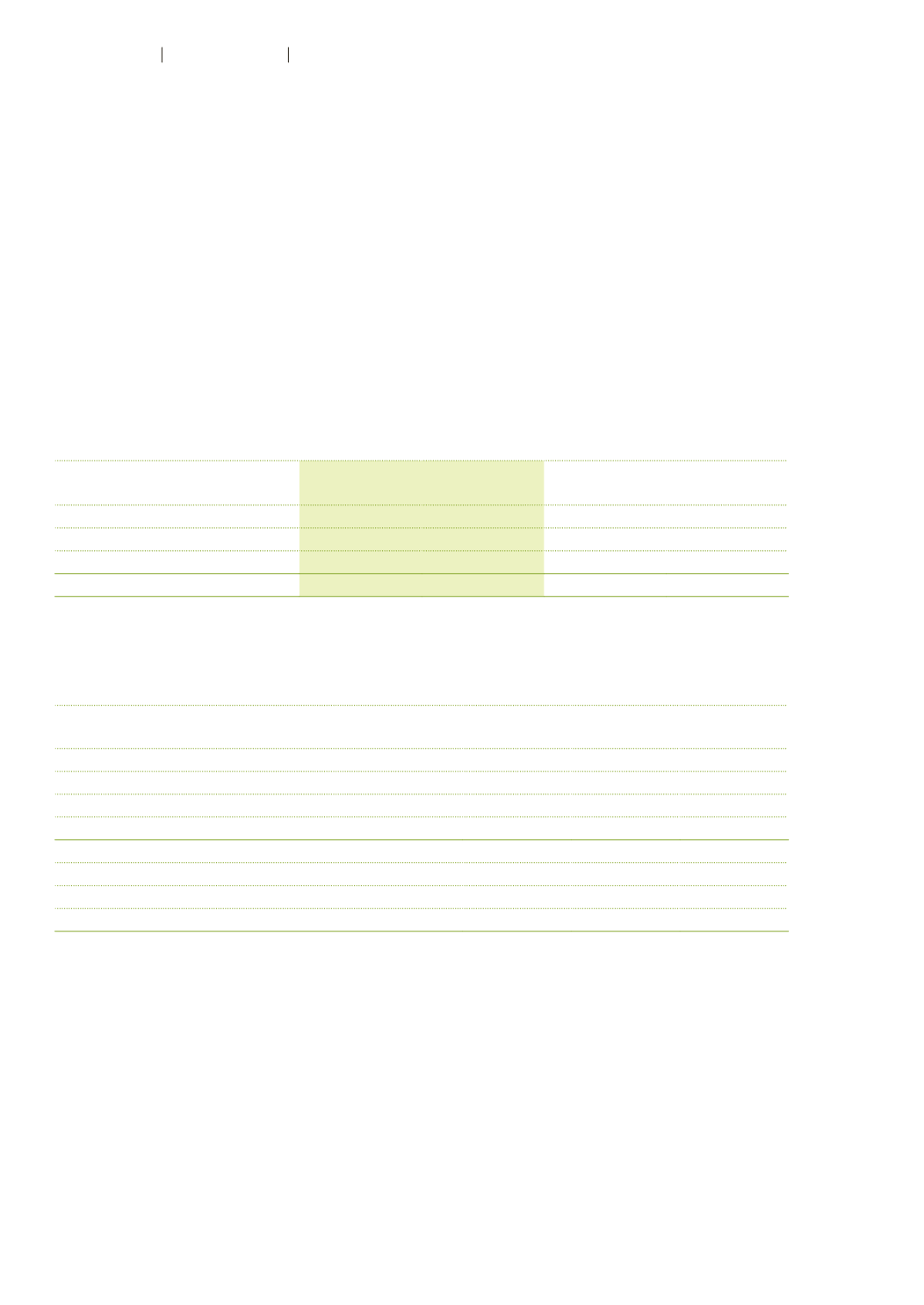

CHF million

Assets

31.12.2016

Liabilities

31.12.2016

Assets

31.12.2015

Liabilities

31.12.2015

EUR

40.5

24.6

37.9

23.0

USD

23.2

19.5

18.6

18.6

Other

0.7

2.3

1.4

1.2

Total

64.4

46.4

57.8

42.8

The Group is exposed to foreign exchange risk mostly against the euro and the US dollar. The currency-

related sensitivity of the Group against these two currencies is shown in the following table:

CHF million

Reasonable

shift

Impact on

net result

Impact on

equity

December 31, 2016

EUR/CHF

+/–2%

+/–0.6

+/–1.3

USD/CHF

+/–2%

+/–0.8

+/–5.8

December 31, 2015

EUR/CHF

+/–15%

–/+1.0

+/–9.3

USD/CHF

+/–5%

+/–2.1

+/–8.3

The impact on net result is mainly due to foreign exchange gains and losses on trade receiv-

ables and trade payables as well as the translation of the profit or loss of foreign subsidiaries into

Swiss francs for consolidation purposes. The impact on equity additionally includes currency

translation adjustments arising from the translation of the net investment in foreign subsidiaries.

82

Autoneum

Financial Report 2016

Consolidated Financial Statements