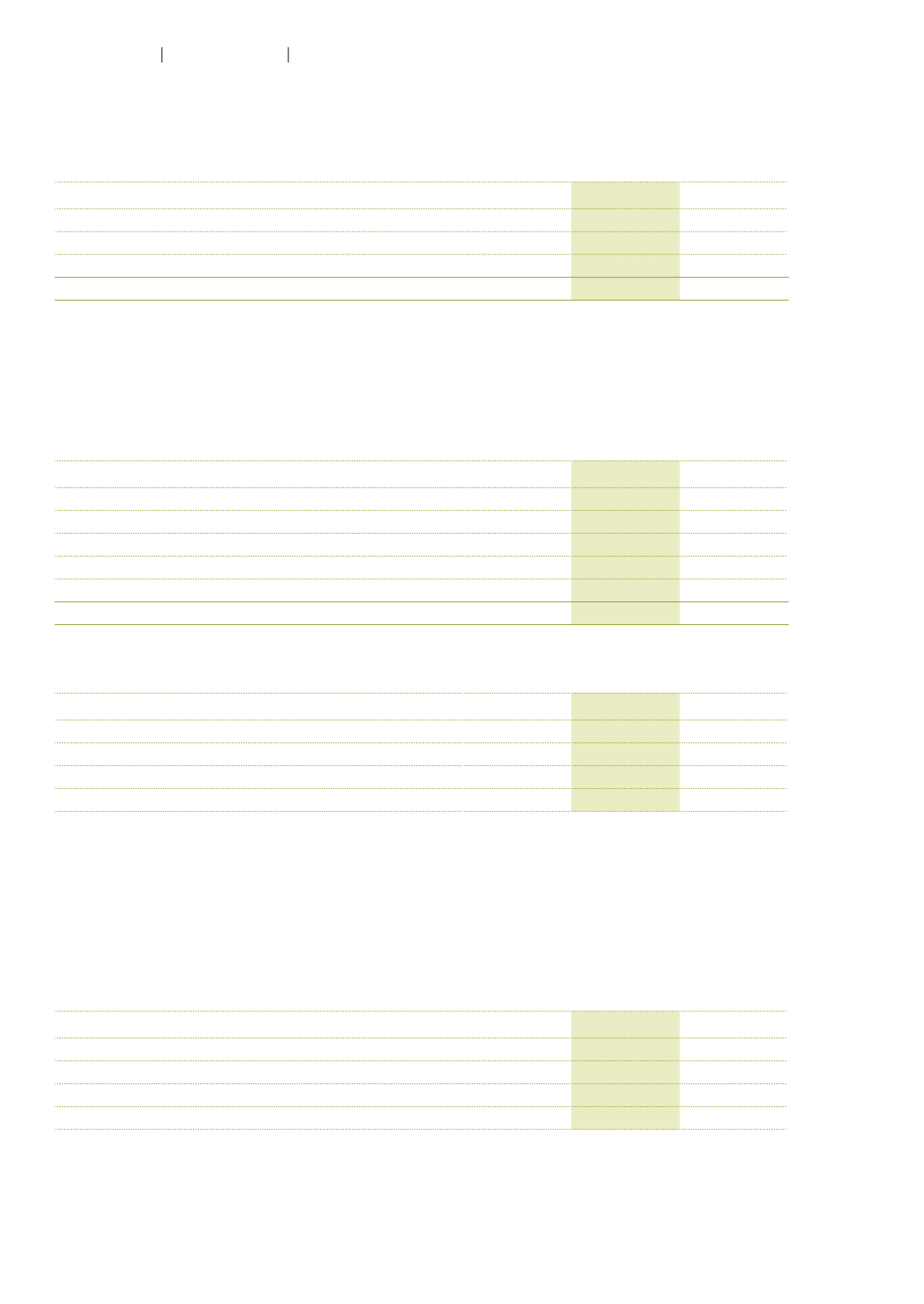

The amounts recognized in the income statement result from plans in the following regions:

CHF million

2015

2014

Expense from defined benefit plans in Switzerland

4.2

3.4

Expense from defined benefit plans in the USA

1.4

1.0

Expense from defined benefit plans in other countries

1.1

1.0

Total

6.6

5.4

The expected employer contributions for the Group’s defined benefit pension plans for 2016 amount

to CHF 6.5 million. The expected benefit payments for 2016 are CHF 7.6 million.

The effect from remeasurement of the defined benefit pension plans recognized in other comprehen-

sive income is as follows:

CHF million

2015

2014

Remeasurement gains and losses

from changes in demographic assumptions

1.0

–3.9

from changes in financial assumptions

-

–22.1

from experience adjustment

–5.4

–2.0

Return on plan assets excluding interest income

0.9

9.2

Total

–3.5

–18.8

The table below discloses the main actuarial assumptions at year-end:

Weighted average of all pension plans

31.12.2015 31.12.2014

Discount rate

in %

2.2

2.4

Expected future salary growth

in %

0.6

0.5

Life expectancy for females at age of 65

in years

24.5

23.9

Life expectancy for males at age of 65

in years

22.1

21.5

At December 31, 2015, the weighted average duration of the defined benefit obligation was 17.1 years

(2014: 16.7 years).

The table below shows the results of the sensitivity analysis. It was analyzed how expected changes

in the discount rate and expected changes in the future salary growth would impact the defined

benefit obligation. A change in the discount rate by 0.25 points or a change in the future salary growth

rate by 0.5 points would have had the following effect on the defined benefit obligation:

CHF million

31.12.2015 31.12.2014

Increase in discount rate by 0.25 percentage point

–8.2

–8.0

Decrease in discount rate by 0.25 percentage point

8.7

8.6

Increase in future salary growth by 0.5 percentage point

2.1

2.7

Decrease in future salary growth by 0.5 percentage point

–2.2

–2.7

96

Autoneum

Financial Report 2015

Consolidated financial statements