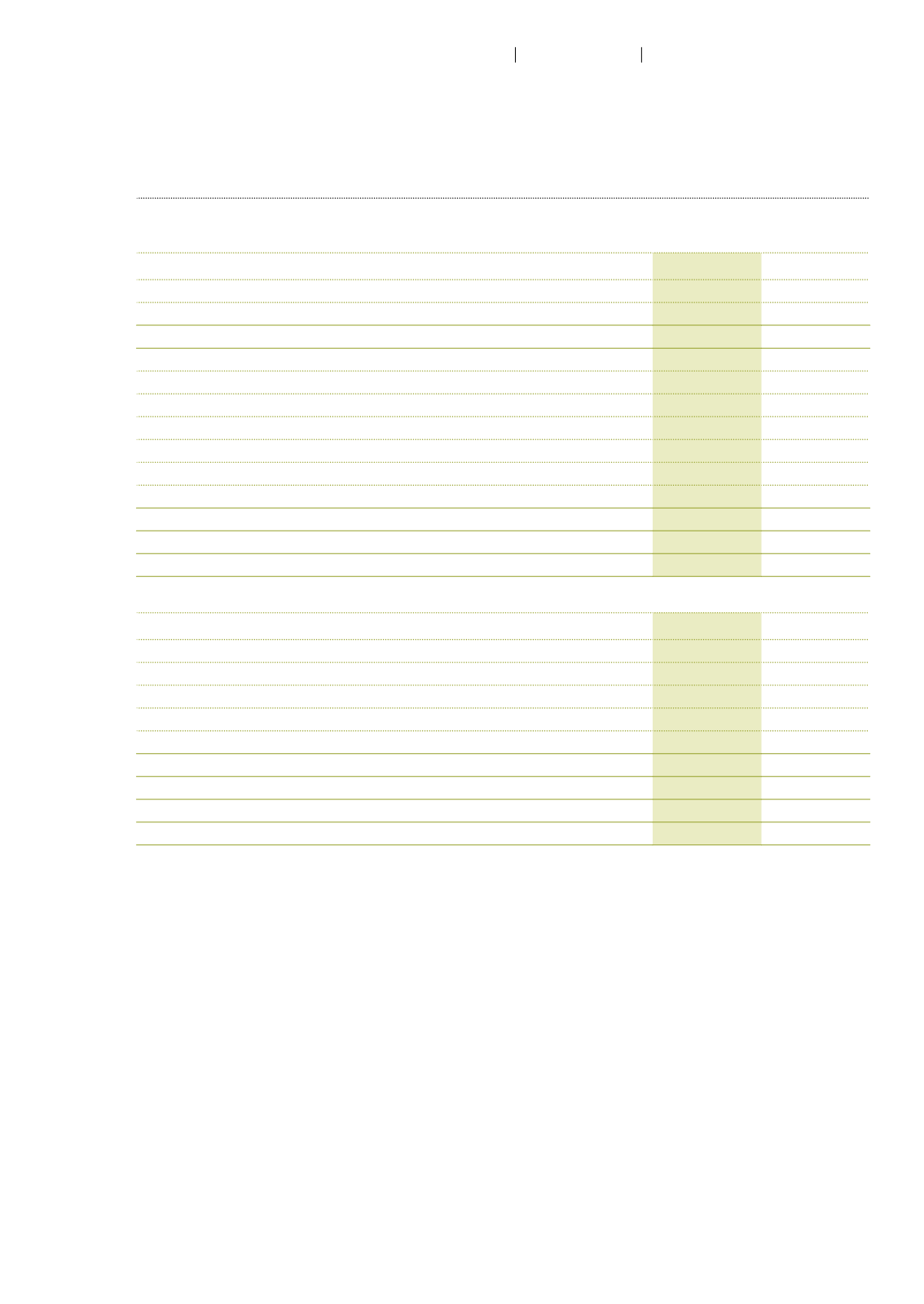

30 Financial instruments

The following tables summarize all financial instruments classified by categories according to IAS 39.

CHF million

31.12.2015 31.12.2014

Marketable securities

1

0.1

0.2

Fair value of derivative financial instruments

2

0.7

0.1

Total financial assets at fair value through profit or loss

0.9

0.3

Cash at banks

77.1

112.9

Time deposits with original maturities up to 3 months

1.6

27.9

Loans

7.7

8.4

Trade receivables

254.9

220.3

Other receivables

92.2

88.3

Other financial assets

7.2

8.2

Total loans and receivables

440.7

466.1

Investments in non-consolidated companies

1

21.1

15.3

Total available-for-sale financial assets

21.1

15.3

Total

462.6

481.6

CHF million

31.12.2015 31.12.2014

Borrowings

184.9

195.6

Trade payables

243.3

250.4

Accrued expenses

51.2

42.2

Non-income tax payables

12.0

14.4

Other payables

29.7

33.2

Total financial liabilities at amortized cost

521.2

535.8

Fair value of derivative financial instruments

2

1.8

2.5

Total financial liabilities at fair value through profit or loss

1.8

2.5

Total

523.0

538.3

1

Measured at fair values that are based on quoted prices in active markets (level 1).

2

Measured at fair values that are calculated based on observable market data (level 2).

Borrowings comprise the bond with a net book value of CHF 124.6 million (2014: CHF 124.4 million)

and a fair value of CHF 132.0 million (2014: CHF 133.9 million) based on quoted prices in active

markets. Refer to note 24 (p. 92) for further information. The book values of other financial instruments

measured at amortized cost correspond to their fair values.

99

Autoneum

Financial Report 2015

Consolidated financial statements