Notes to the financial statements of Autoneum Holding Ltd

1 Principles

General

Autoneum Holding Ltd was incorporated on December 2, 2010, as a Swiss corporation headquartered

in Winterthur. The company does not have any employees.

These financial statements were prepared according to the provisions of the Swiss Law on Accoun-

ting and Financial Reporting (32

nd

title of the Swiss Code of Obligations) for the first time. The

presentation of the prior year figures was adjusted accordingly to allow comparability. Where not

prescribed by law, the significant accounting and valuation principles applied are described below.

Loans

Loans granted in foreign currencies are translated at the rate at the balance sheet date, whereby

unrealized losses are recorded but unrealized profits are not recognized. In the case where the

currency effect of loans is hedged, both unrealized losses and profits are recognized.

Treasury shares

Treasury shares are recognized at acquisition cost and deducted from shareholders’ equity at

the time of acquisition. In case of a sale, the gain or loss is recognized in the income statement as

financial income or financial expenses.

Financial liabilities due to banks and bond

Financial liabilities are recognized in the balance sheet at nominal value. The issue costs for the

bond and for finance agreements are recognized as accruals due from third parties and amortized

on a straight-line basis over the maturity period.

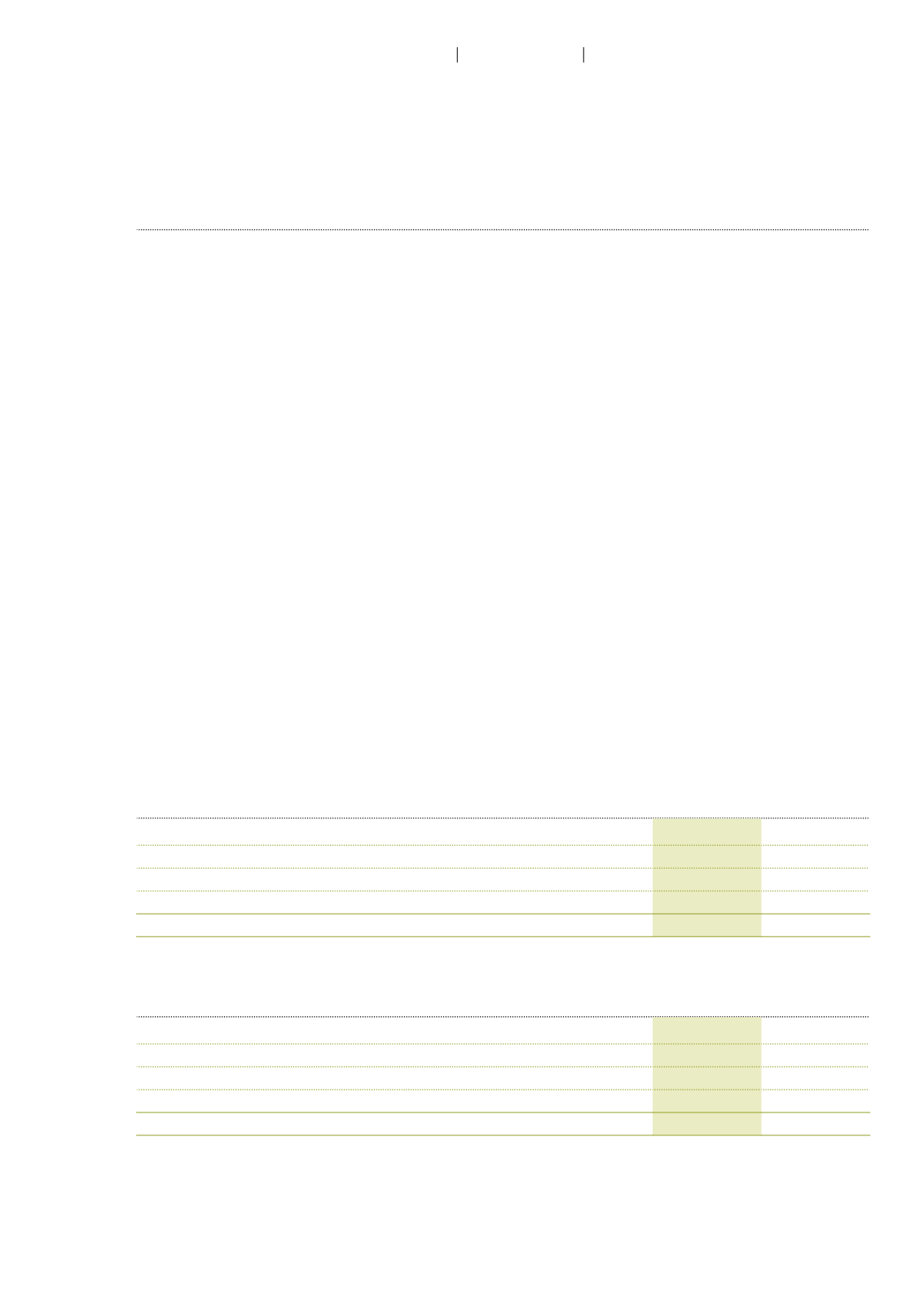

2 Other financial income

CHF million

2015

2014

Interest income

10.3

15.0

Net foreign exchange gains

-

4.0

Other financial income

0.1

0.8

Total

10.4

19.9

3 Financial expenses

CHF million

2015

2014

Interest expenses

7.3

9.1

Net foreign exchange losses

8.6

-

Other financial expenses

0.7

-

Total

16.6

9.1

111

Autoneum Financial Report 2015

Financial statements of Autoneum Holding Ltd