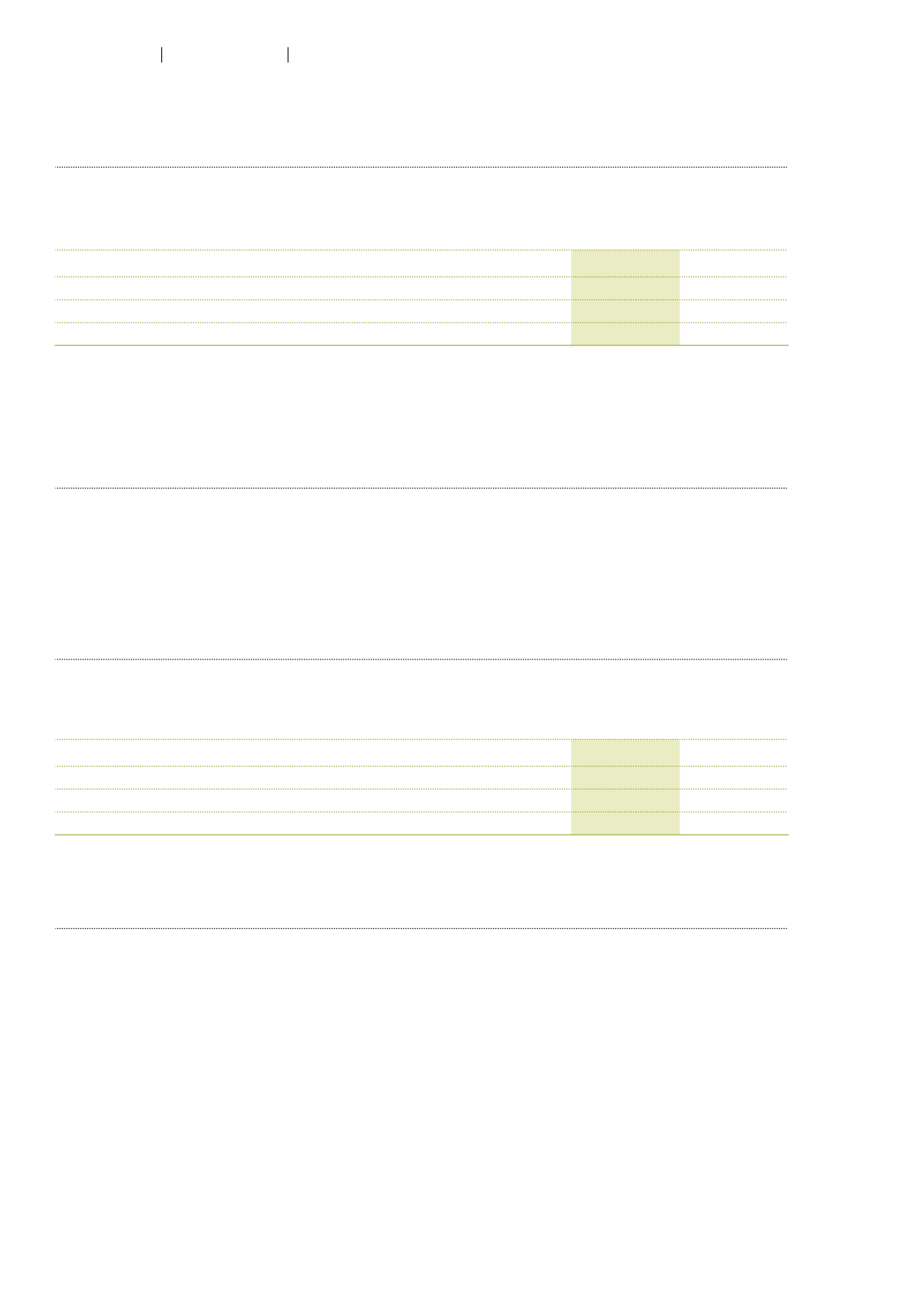

4 Loans and receivables due from subsidiaries

Loans due from subsidiaries in current assets contains both current loans and cash pool receivables.

The split at year-end is as follows:

CHF million

31.12.2015 31.12.2014

Current loans

118.9

96.9

Cash-pool receivables

27.6

10.9

Total

146.5

107.8

Non-current loans due from subsidiaries in the amount of CHF 10.6 million are subordinated.

5 Investments

Autoneum Holding Ltd recapitalized subsidiaries by converting loans into equity in 2015 and 2014.

Participation levels were increased accordingly. The subsidiaries and associated companies are listed

in note 13 on page 115. They are owned directly or indirectly by Autoneum Holding Ltd.

6 Financial liabilities due to subsidiaries

Financial liabilities due to subsidiaries in current liabilities contain both short-term loans and cash

pool liabilities. The split at year-end is as follows:

CHF million

31.12.2015 31.12.2014

Current loans

59.1

10.3

Cash-pool liabilities

36.8

41.8

Total

95.9

52.2

7 Bond

On December 14, 2012, Autoneum Holding Ltd issued a fixed rate bond with a nominal value

of CHF 125.0 million, which is listed on the SIX Swiss Exchange (AUT12, ISIN: CH0196770439).

The bond carries a coupon rate of 4.375%, and has a term of five years with a final maturity on

December 14, 2017.

112

Autoneum Financial Report 2015

Financial statements of Autoneum Holding Ltd