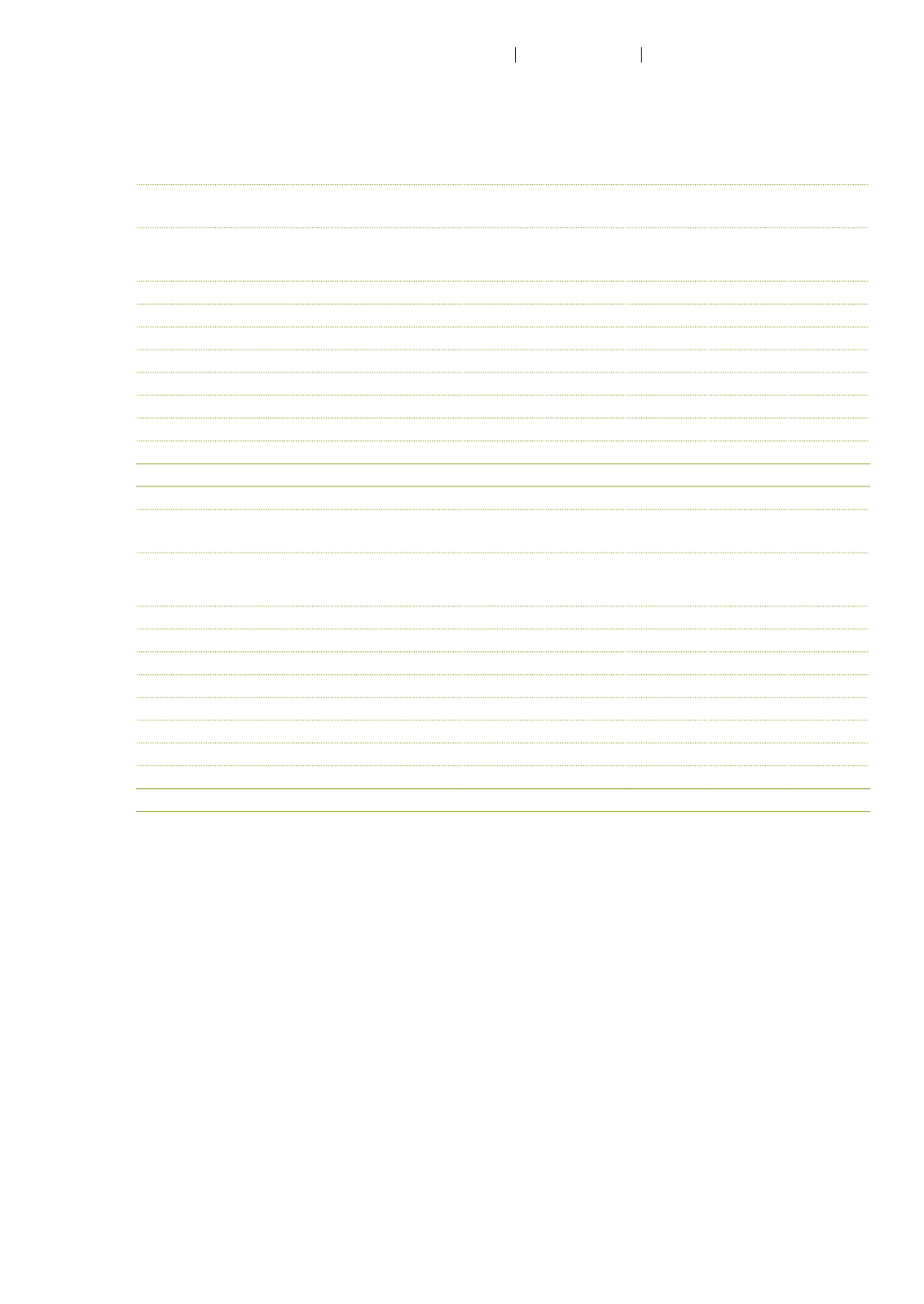

The table below shows the contractual maturities of Autoneum’s financial liabilities (including interest):

Financial liabilities at December 31, 2015

Carrying

amount

Contractual undiscounted cash flows

CHF million

Less than

1 year

1 to 5

years

More

than 5

years

Total

cash flow

Bond

124.6

5.5

130.5

-

136.0

Bank debt

58.3

17.3

46.5

-

63.8

Finance leasing obligations

0.5

0.5

-

-

0.5

Other borrowings

1.5

0.1

1.8

-

1.8

Trade payables

243.3

243.3

-

-

243.3

Accrued expenses

51.2

51.2

-

-

51.2

Non-income tax payables

12.0

12.0

-

-

12.0

Other payables

29.7

28.3

1.4

-

29.7

Total

521.2

358.2

180.2

-

538.4

Financial liabilities at December 31, 2014

Carrying

amount

Contractual undiscounted cash flows

CHF million

Less than

1 year

1 to 5

years

More

than 5

years

Total

cash flow

Bond

124.4

5.5

135.9

-

141.4

Bank debt

67.3

20.9

50.9

-

71.7

Finance leasing obligations

0.7

0.2

0.5

-

0.7

Other borrowings

3.3

2.2

1.6

-

3.8

Trade payables

250.4

250.4

-

-

250.4

Accrued expenses

42.2

42.2

-

-

42.2

Non-income tax payables

14.4

14.4

-

-

14.4

Other payables

33.2

31.4

1.8

-

33.2

Total

535.8

367.2

190.7

-

557.7

77

Autoneum

Financial Report 2015

Consolidated financial statements