8 Financial liabilities due to banks

Autoneum maintains a long-term credit agreement with a banking syndicate in the amount of

CHF 150.0 million. The line of credit may partly be used as a guarantee facility. The final maturity

date is December 31, 2019. The interest rate is based on the LIBOR rate plus an applicable margin,

which is determined based on the ratio of net debt to EBITDA.

The credit agreement contains customary financial covenants, which include the ratio of net

debt to EBITDA and a minimal financial equity. Compliance with financial covenants was checked

quarterly and reported to the banking syndicate. In fiscal years 2015 and 2014, the minimum financial

requirements were met at all times.

9 Shareholders’ equity

Share capital

The share capital amounts to CHF 233618.15. It is divided into 4672 363 fully paid registered shares

with a par value of CHF 0.05 each.

Conditional share capital

For issuing bonds and/or granting shareholder options, the share capital can be increased by

a maximum of 700000 paid registered shares with a par value of CHF 0.05 up to a maximum value

of CHF 35000. Furthermore, for the issue of shares to employees and subsidiaries, the share capital

can be increased by a maximum of 250000 paid registered shares with a par value of CHF 0.05

up to a maximum value of CHF 12 500.

Legal capital reserves

These reserves include an amount of CHF 0.1 million (2014: CHF 21.0 million) whose distribution as

dividends is not subject to income taxes in Switzerland and can be effected free of Swiss with-

holding tax. The remaining part of the legal capital reserve does not benefit from the Swiss capital

contribution principle.

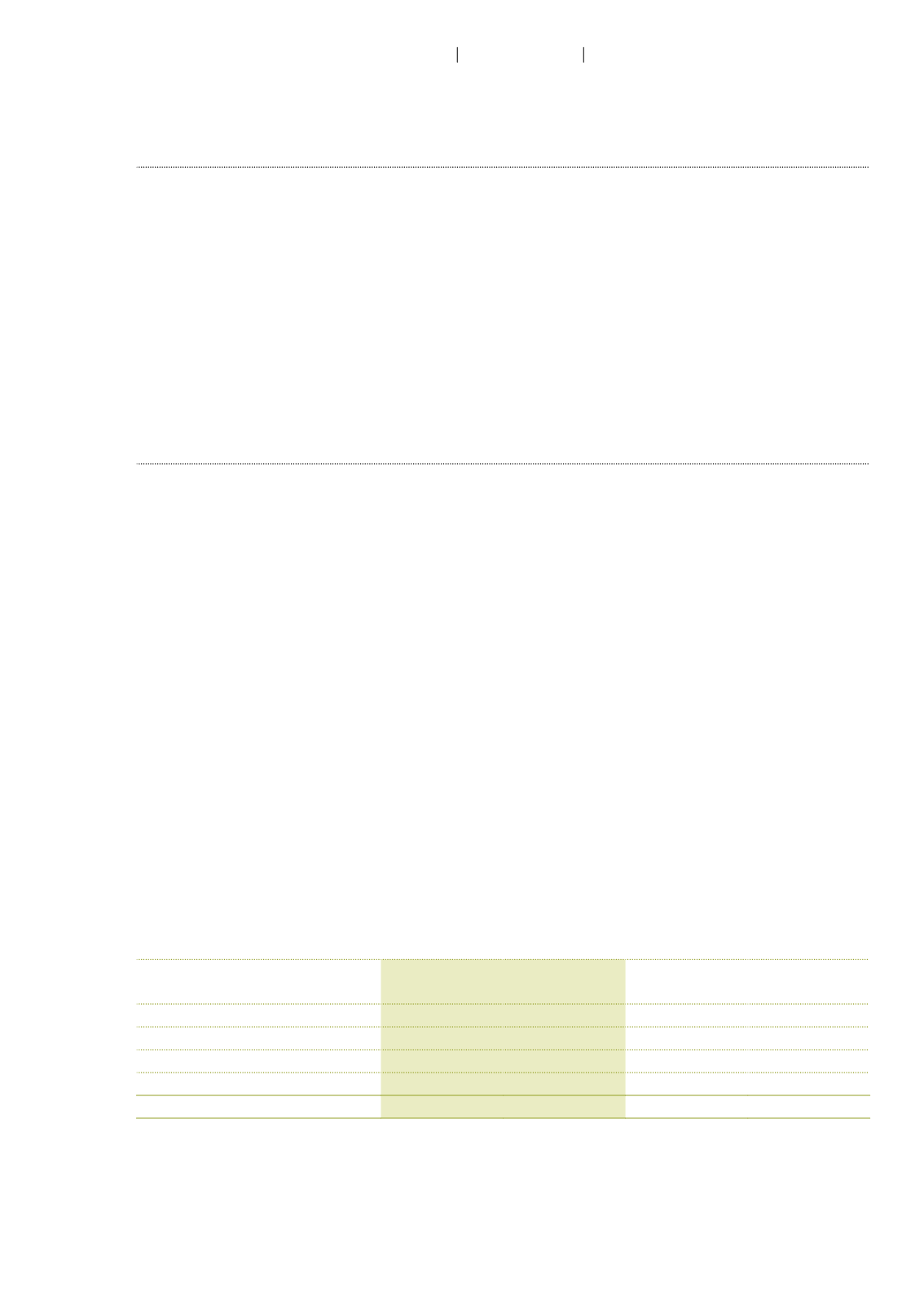

Treasury shares

The following transactions with treasury shares were performed during the financial year:

2015

in shares

2015

in CHF million

2014

in shares

2014

in CHF million

Treasury shares at January 1

53 180

6.1

36 062

2.3

Purchase of treasury shares

634

0.1

28 069

4.7

Sale of treasury shares

–12 891

–1.5

–6 846

–0.6

Transfer of treasury shares

–3 311

–0.4

–4 105

–0.4

Treasury shares at December 31

37 612

4.3

53 180

6.1

113

Autoneum Financial Report 2015

Financial statements of Autoneum Holding Ltd