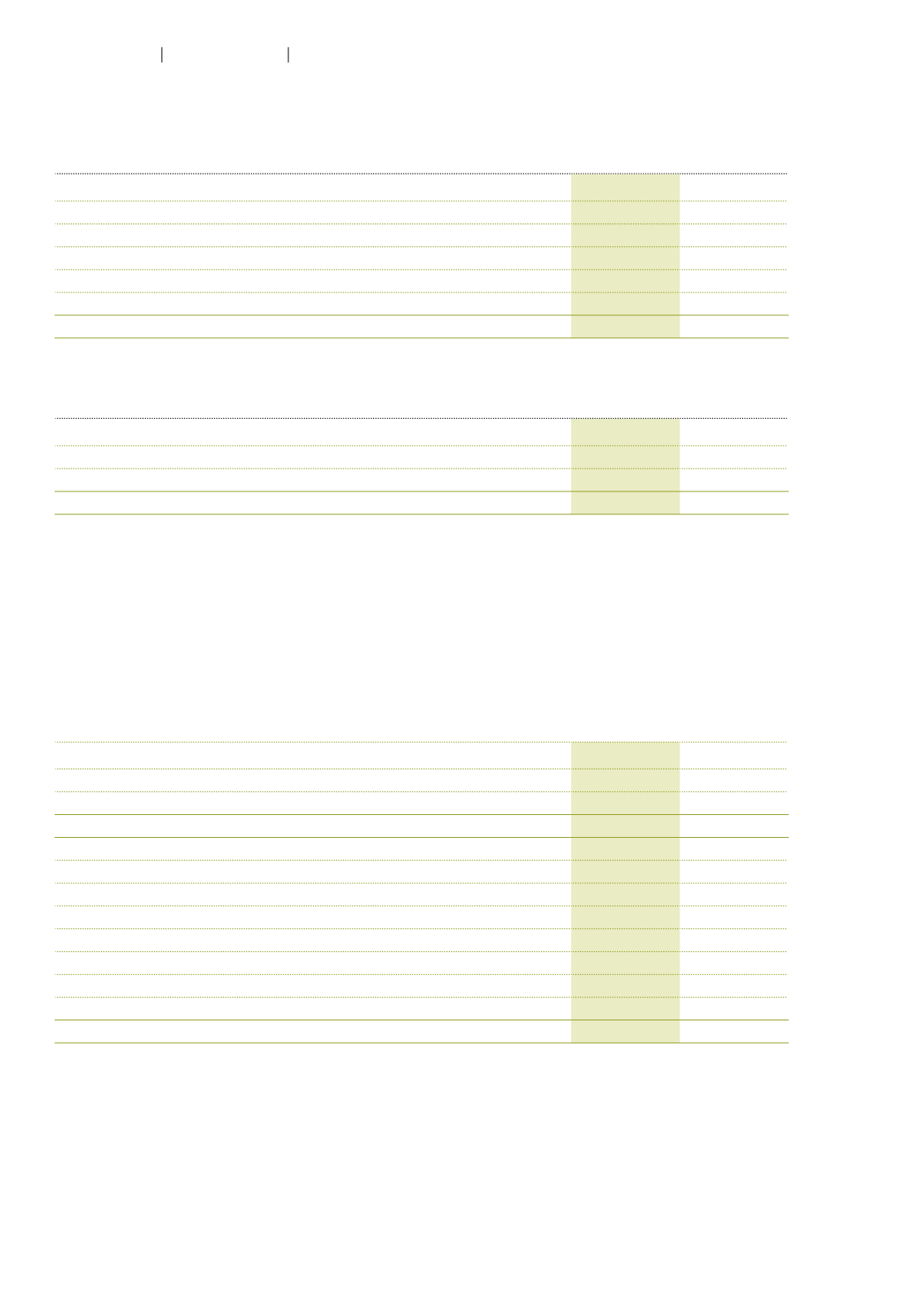

10 Financial expenses

CHF million

2015

2014

Interest expenses

11.1

12.4

Amortization of transaction costs

0.3

1.1

Interest expenses for defined benefit pension plans

0.9

0.3

Net foreign exchange losses

7.5

2.5

Other financial expenses

0.4

0.1

Total

20.2

16.4

11 Income taxes

CHF million

2015

2014

Current income taxes

39.6

33.3

Deferred income taxes

0.8

–16.0

Total

40.5

17.3

The decrease in the net deferred income tax assets by CHF 1.1 million (2014: decrease by CHF 21.4

million) relates to the deferred income tax expense recognized in the consolidated income statement

of CHF 0.8 million (2014: deferred income tax income of CHF 16.0 million), to the deferred income

tax income recognized in other comprehensive income of CHF 0.7 million (2014: income tax income of

CHF 5.3 million) and to a currency translation adjustment of CHF –1.0 million (2014: CHF 0.1 million).

Reconciliation of expected and actual income tax expenses:

CHF million

2015

2014

Profit before taxes

109.2

120.1

Expected average tax rate

30.4%

28.5%

Expected income tax expenses

33.2

34.2

Non-taxable income and non-deductible expenses

4.7

1.4

Current income taxes from prior periods

4.4

2.8

Current year tax losses for which no deferred tax assets were recognized

12.4

5.7

Utilization of previously unrecognized tax loss carry-forwards

–8.6

–11.1

Change in unrecognized tax losses and deductible temporary differences

–1.4

–18.6

Income taxes at other tax rates

–4.9

2.8

Impact of changes in tax rates

0.8

0.1

Other effects

–0.1

-

Actual income tax expenses

40.5

17.3

The change in the expected average tax rate is due to the different geographic composition of

profit or loss before tax.

82

Autoneum

Financial Report 2015

Consolidated financial statements