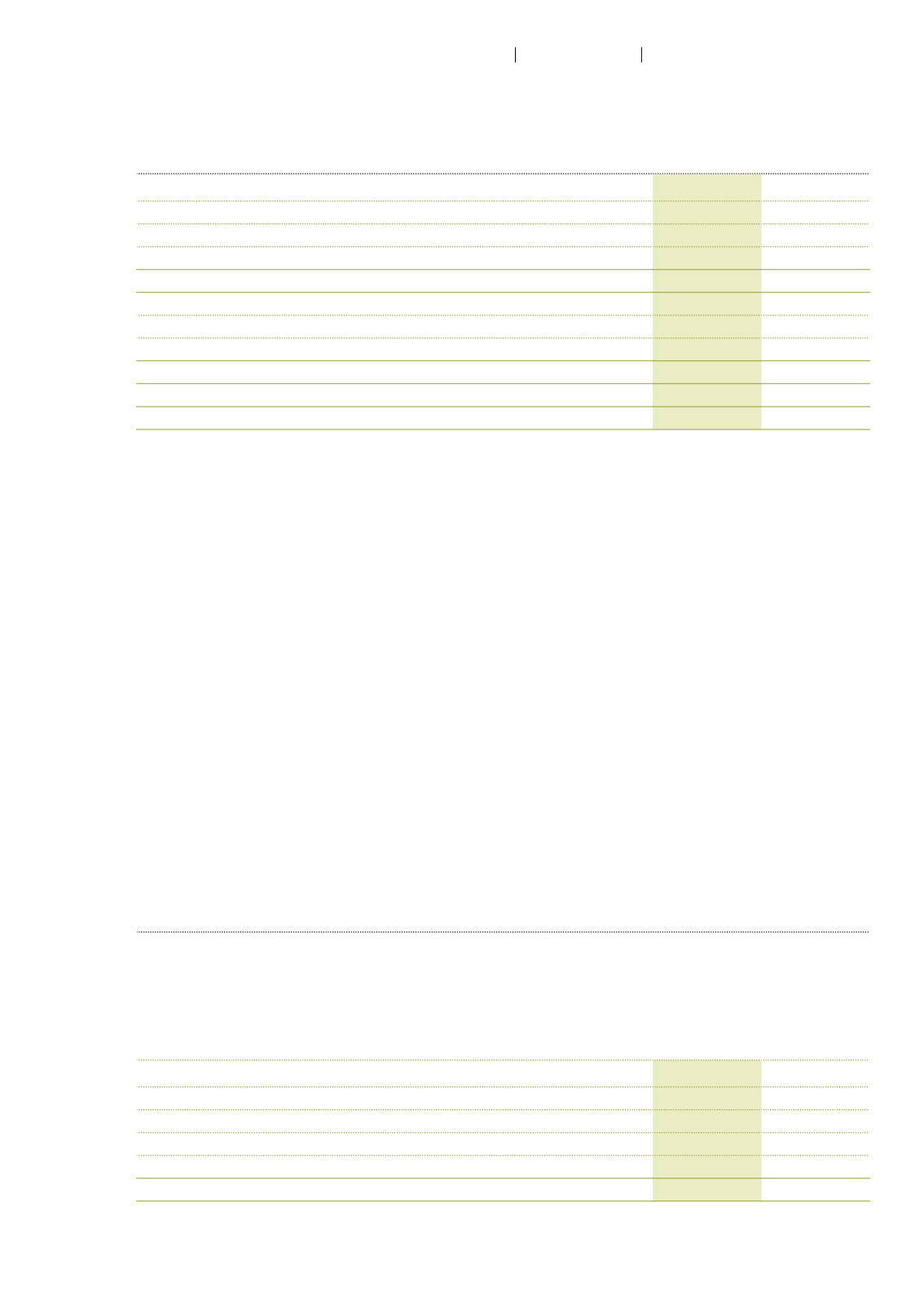

14 Intangible assets

CHF million

2015

2014

Cost at January 1

12.7

9.7

Additions

1.5

3.1

Currency translation adjustment

–0.3

–0.1

Cost at December 31

14.0

12.7

Accumulated amortization at January 1

–2.6

–1.7

Amortization

–1.7

–1.0

Currency translation adjustment

0.2

0.1

Accumulated amortization at December 31

–4.1

–2.6

Net book value at January 1

10.0

7.9

Net book value at December 31

9.8

10.0

Intangible assets comprise mainly investments in a new ERP system.

In 2015, CHF 60.7 million was spent on research and development (2014: CHF 57.1 million).

Autoneum Group invests in innovative materials and products, and in new efficient production

technologies to support vehicle manufacturers in meeting challenging targets in acoustic comfort,

fuel consumption and environmental emissions, in an increasingly cost-competitive environment.

The focus in the last few years was in the development of extremely lightweight and acoustically

efficient solutions for carpet, interior insulation and underbody aerodynamic covers and heatshields.

In addition, emphasis was given to further developing Autoneum’s pioneering powertrain encapsu

lation solutions for the reduction of exterior noise and carbon dioxide emissions.

Development costs must meet several criteria to be recognized as an intangible asset. Technical

and financial resources must be available to ensure the completion of the development, and the

costs attributed to the development must be reliably measured. Although for all major development

projects in 2015 and 2014 this was the case, and the intention and ability to complete the projects

was confirmed by the management, no development costs could be capitalized as intangible assets

during the reporting year as in the previous year. Due to rapid technological changes, the required

proof of future economic benefits could not be sufficiently supported.

15 Investments in associated companies

Investments in associated companies comprise the 49% share in SHN CO., Ltd., Daegu (Korea),

the 30% share in SRN Sound Proof Co., Ltd., Chonburi (Thailand), and the 25% share in Wuhan

Nittoku Autoneum Sound-Proof Co. Ltd., Wuhan (China). The investments are measured using

the equity method. The net book value of investments in associated companies changed as follows:

CHF million

2015

2014

Net book value at January 1

6.4

4.9

Additions

0.5

0.6

Share of profit

1.9

0.4

Currency translation adjustment

–0.4

0.5

Net book value at December 31

8.3

6.4

85

Autoneum

Financial Report 2015

Consolidated financial statements