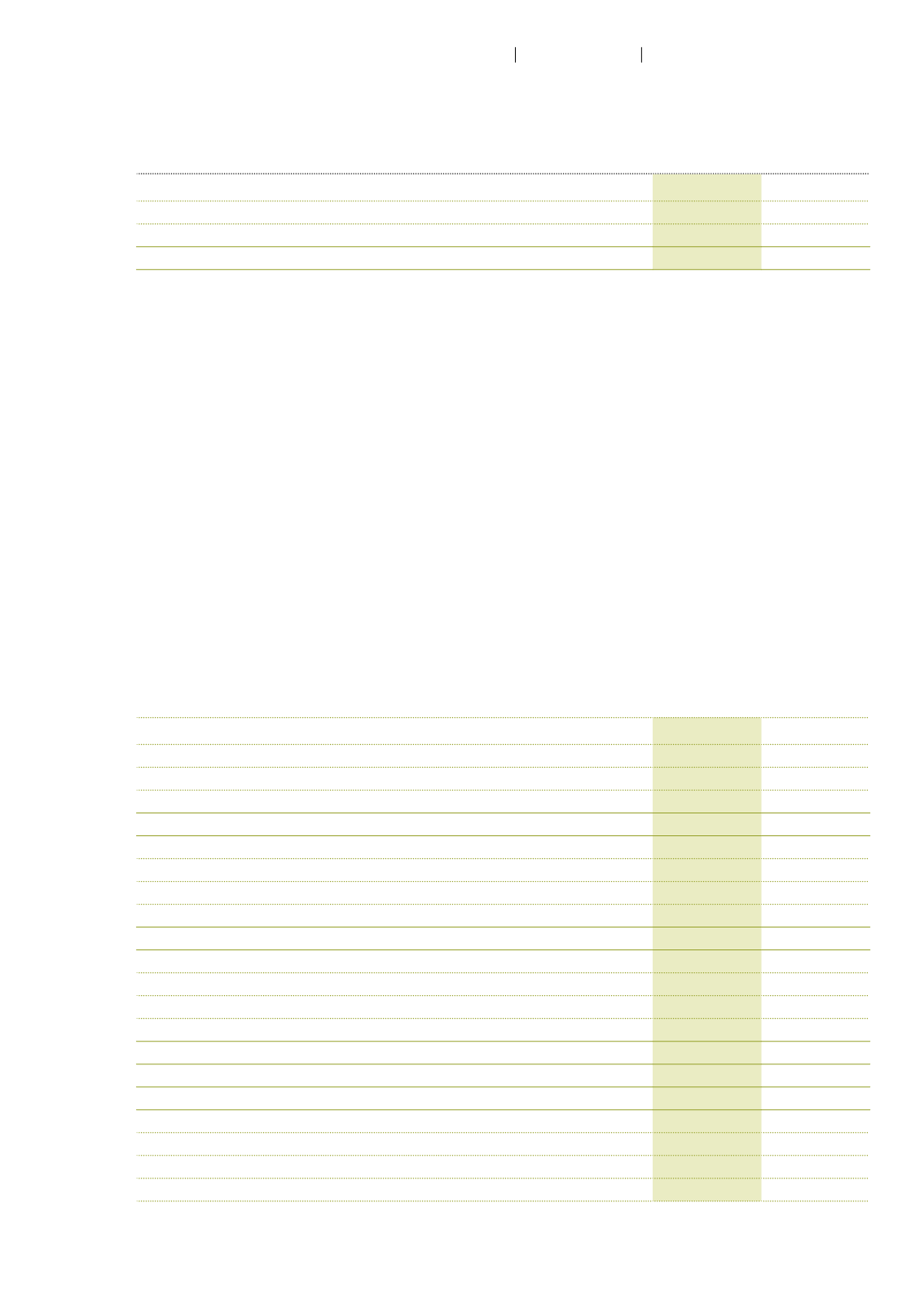

25 Employee benefits

CHF million

31.12.2015 31.12.2014

Post-employment benefit liabilities

27.7

30.1

Other long-term employee benefits

1.1

1.6

Employee benefit liabilities

28.8

31.7

The costs for pensions are charged to employee and interest expenses and for the current reporting

year totaled CHF 18.1 million (2014: CHF 12.8 million).

Some employees participate in defined contribution plans whose insurance benefit results solely

from the paid contributions and the return on investment on the plan asset. The other employees

participate in defined benefit plans that are based upon direct benefits of Autoneum Group.

Defined contribution plans

The expenses for defined contribution plans totaled CHF 11.3 million in the current reporting year

(2014: CHF 7.4 million).

Defined benefit plans

Autoneum maintains defined benefit pension plans in Switzerland, Great Britain, the USA and

Canada. The most significant pension plans are the Swiss and the US pension plans. Those plans

sum up to 81.7% (2014: 78.1%) of the Group’s defined benefit obligation and to 81.0% (2014:

78.5%) of the Group’s plan assets.

The status of the defined benefit plans at year-end was as follows:

CHF million

2015

2014

Switzerland

Fair value of plan assets at December 31

116.5

111.0

Present value of defined benefit obligation at December 31

–122.3

–111.1

Deficit at December 31

–5.9

–0.1

USA

Fair value of plan assets at December 31

30.1

31.2

Present value of defined benefit obligation at December 31

–47.2

–49.4

Deficit at December 31

–17.1

–18.2

Other countries

Fair value of plan assets at December 31

34.3

38.9

Present value of defined benefit obligation at December 31

–38.0

–44.5

Deficit at December 31

–3.7

–5.6

Total deficit at December 31

–26.7

–23.9

Recognized in the balance sheet

as employee benefit assets

1.0

6.2

as employee benefit liabilities

–27.7

–30.1

93

Autoneum

Financial Report 2015

Consolidated financial statements