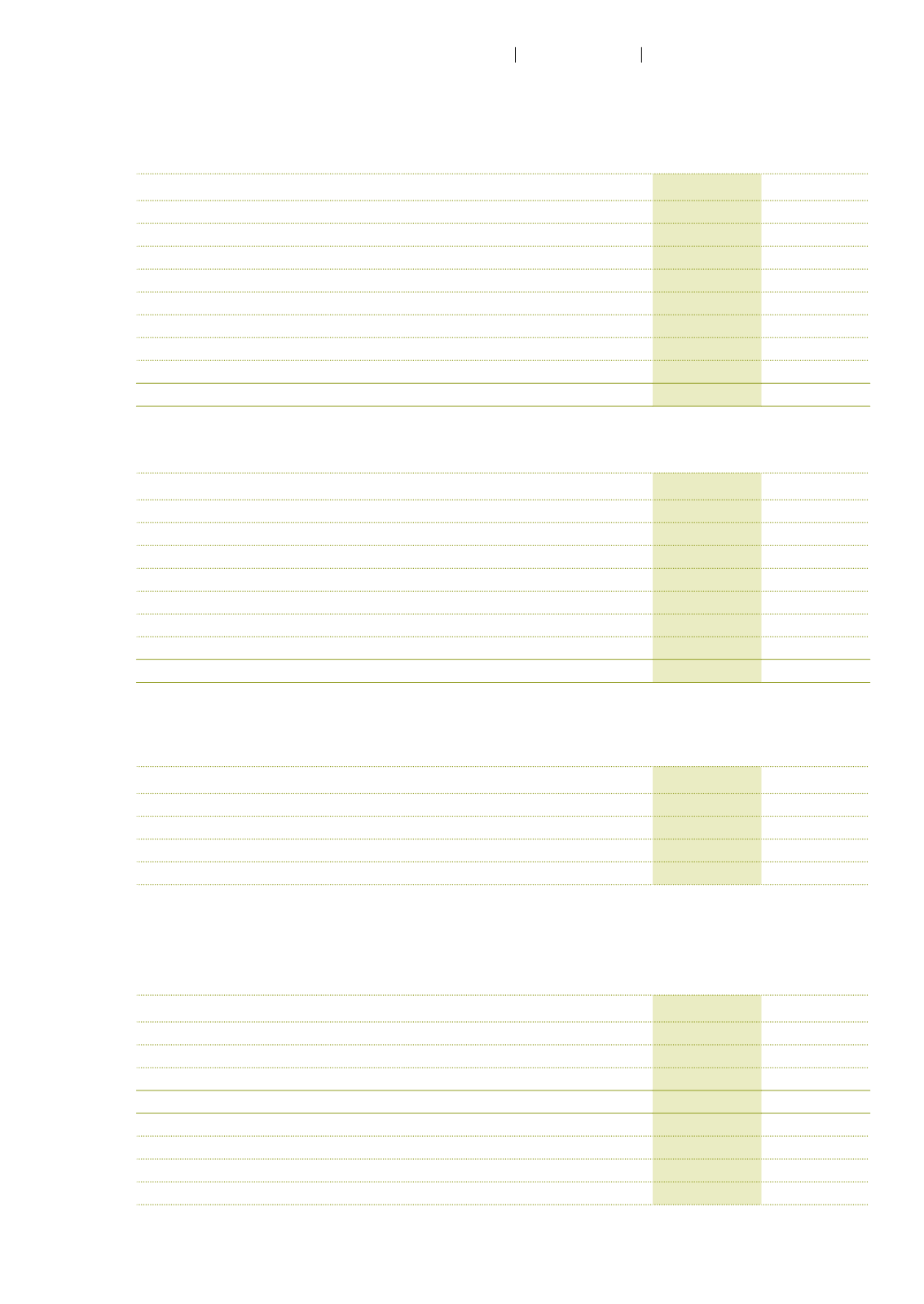

The movement in the defined benefit obligation over the year was as follows:

CHF million

2015

2014

Defined benefit obligation at January 1

205.0

163.9

Current service cost

6.3

5.1

Past service cost

–0.6

-

Interest expenses

4.6

5.5

Remeasurement gains and losses

4.4

28.0

Employee contributions

3.0

2.9

Benefits paid

–8.9

–6.5

Currency translation adjustment

–6.2

6.1

Defined benefit obligation at December 31

207.6

205.0

The movement in the fair value of plan assets over the year was as follows:

CHF million

2015

2014

Fair value of plan assets at January 1

181.1

158.3

Interest income

3.7

5.2

Return on plan assets excluding interest income

0.9

9.2

Employer contributions

6.8

7.8

Employee contributions

3.0

2.9

Benefits paid

–8.9

–6.5

Currency translation adjustment

–5.7

4.2

Fair value of plan assets at December 31

180.9

181.1

The major categories of plan assets as a percentage of total plan assets were as follows:

in %

31.12.2015 31.12.2014

Equity

44

44

Debt

33

31

Real estate

10

6

Other

13

19

All equity and debt instruments are listed on a stock exchange.

The amounts recognized in the income statement were as follows:

CHF million

2015

2014

Current service cost

6.3

5.1

Past service cost

–0.6

-

Net interest expenses

0.9

0.3

Pension expenses for defined benefit plans

6.6

5.4

Recognized in the income statement:

as employee expenses

5.8

5.1

as interest expenses

0.9

0.3

95

Autoneum

Financial Report 2015

Consolidated financial statements