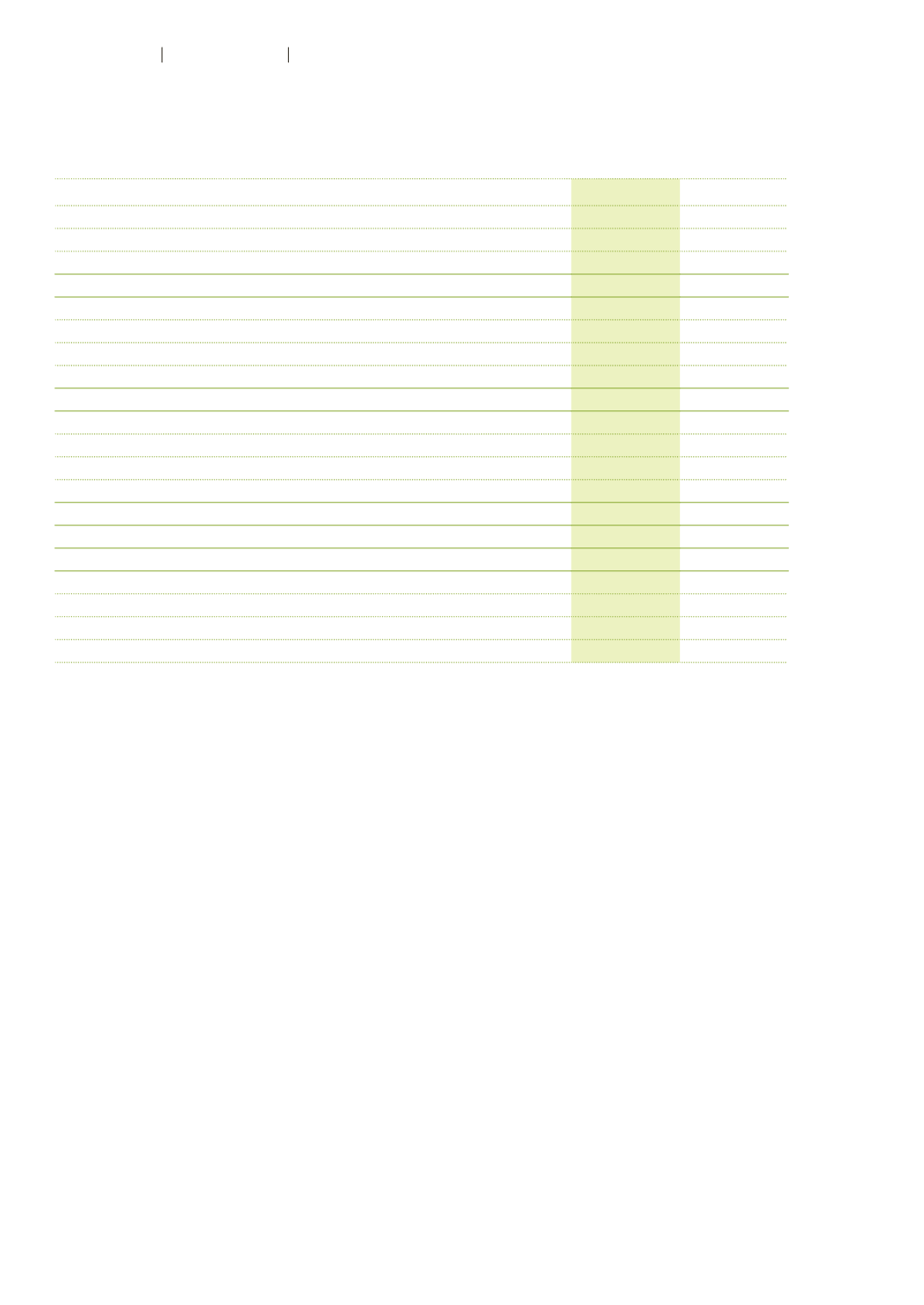

The status of the defined benefit plans at year-end was as follows:

CHF million

2016

2015

Switzerland

Fair value of plan assets at December 31

113.9

116.5

Present value of defined benefit obligation at December 31

–121.6

–122.3

Deficit at December 31

–7.6

–5.9

USA

Fair value of plan assets at December 31

30.8

30.1

Present value of defined benefit obligation at December 31

–48.0

–47.2

Deficit at December 31

–17.1

–17.1

Other countries

Fair value of plan assets at December 31

37.7

34.3

Present value of defined benefit obligation at December 31

–44.1

–38.0

Deficit at December 31

–6.5

–3.7

Total deficit at December 31

–31.2

–26.7

Recognized in the balance sheet

as employee benefit assets

3.4

1.0

as employee benefit liabilities

–34.7

–27.7

Swiss pension plans

Pension plans are governed by the Swiss Federal Law on Occupational Retirement, Survivors’ and

Disability Pension Plans (BVG). The Group’s pension plans are administered by separate legal founda-

tions, which are funded by regular employee and company contributions. Plan participants are

insured against the financial consequences of old age, disability and death. The most senior govern-

ing body of the pension plan is the Board of Trustees. The Board of Trustees is responsible for

the investment of the plan assets. All investment decisions made by the Board of Trustees need to

conform to the guidelines set out in a long-term investment strategy. This strategy is based on

legal requirements, expected future contributions and expected future obligations and is reassessed

at least once a year. All governing and administration bodies have an obligation to act in the

interests of the plan participants. The final benefit is contribution-based with certain minimum guar-

antees. Due to these minimum guarantees, the Swiss plans are treated as defined benefit plans for

the purposes of these IFRS financial statements, although they have many characteristics of defined

contribution plans. Retirement benefits are based on the accumulated savings capital, which can

either be drawn as a lifelong pension or as a lump-sum payment. The pension is calculated by multi-

plying the balance of the savings capital with the applicable conversion rate. The plan is exposed

to actuarial risks, such as longevity risk, interest rate risk and market (investment) risk. In case of

an underfunding, the Board of Trustees is required to take the necessary measures to ensure that

full funding can be expected to be restored within a reasonable period. The measures may include

increasing employee and company contributions, lowering the interest rate on retirement account

balances or reducing prospective benefits.

102

Autoneum

Financial Report 2016

Consolidated Financial Statements