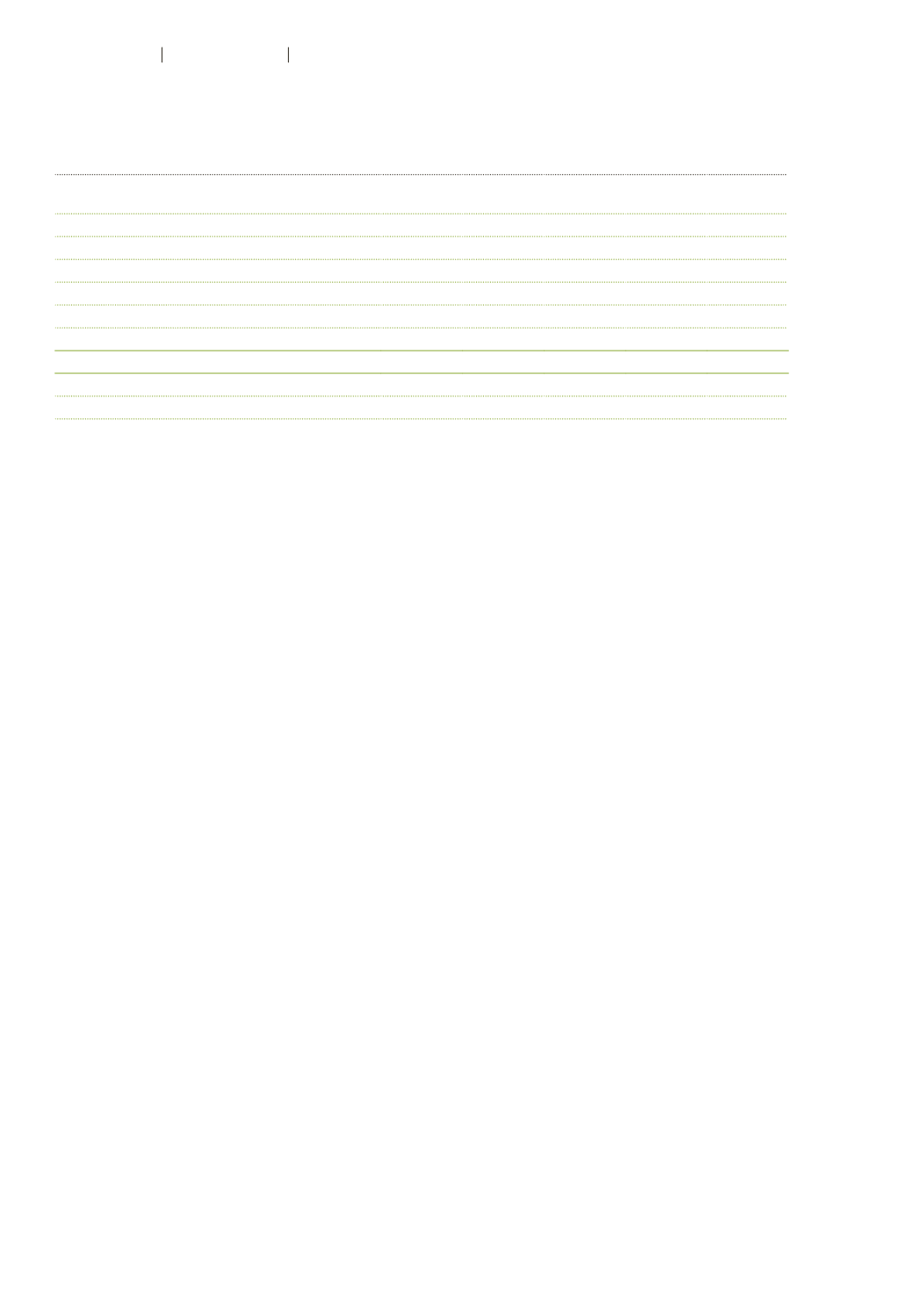

26 Provisions

CHF million

Guarantee

and warranty

Litigation and

tax risk

Environ-

mental

Other

Total

Provisions at January 1, 2016

2.4

37.0

10.3

19.4

69.1

Additions

2.4

10.6

0.9

8.4

22.2

Utilization

–

–0.5

–0.1

–6.1

–6.8

Release

–0.4

–4.9

–

–2.8

–8.1

Reclassification

–

–0.2

–

0.2

–

Currency translation adjustment

–

0.4

–0.1

0.1

0.5

Provisions at December 31, 2016

4.4

42.4

11.0

19.2

77.0

Thereof non-current

2.0

39.0

11.0

11.4

63.3

Thereof current

2.4

3.4

–

7.8

13.7

Guarantee and warranty provisions are related to the production and supply of goods or services

and are based on experience. The non-current guarantee and warranty provisions are expected to be

used in one to two years.

Litigation and tax risk provisions comprise provisions for expected costs resulting from

investigations and proceedings of government agencies, provisions for court cases, such as claims

brought up by workers for health- or accident-related incidents, and provisions for tax risks. The

majority of litigation and tax risk provisions are expected to be used within the next two to three years.

Environmental provisions contain the estimated costs for the cleanup of contaminated sites

due to past industrial operations. The majority of provisions stem from legal entities within Business

Group Europe. Long-term environmental provisions are expected to be used mainly over the next

five to ten years.

Other provisions are made for contracts where the unavoidable costs to fulfill the obligation are

greater than the expected economic benefits, as well as for other constructive or legal liabilities

of Group companies. The majority of other non-current provisions are expected to be used in two to

three years.

106

Autoneum

Financial Report 2016

Consolidated Financial Statements