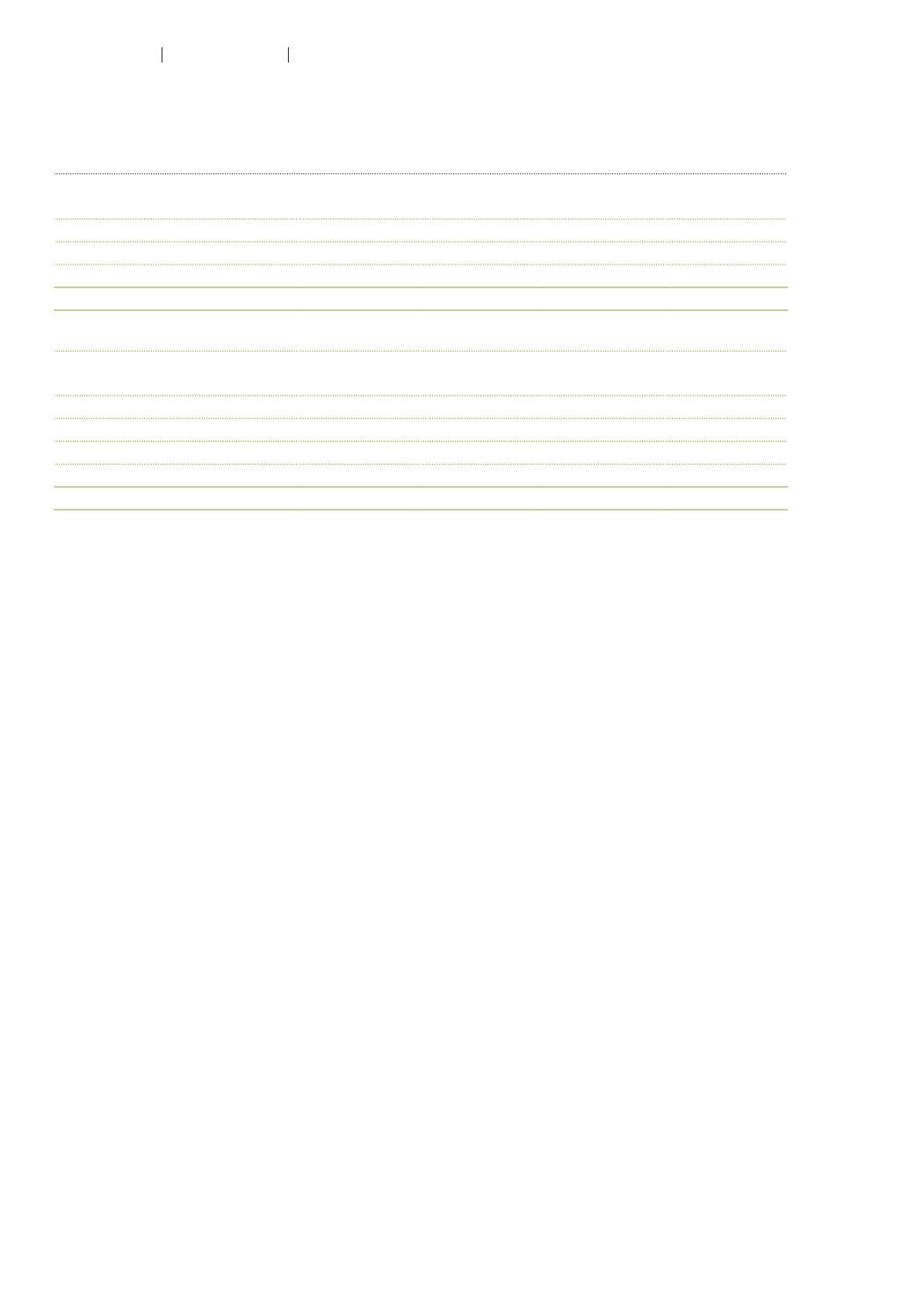

24 Borrowings

CHF million

Duration less than

1 year

Duration

1 to 5 years

Duration 5 and

more years

Total

Bonds

124.8

–

74.7

199.5

Bank debts

5.5

1.6

–

7.1

Other borrowings

–

1.4

0.7

2.1

Total at December 31, 2016

130.3

3.0

75.4

208.7

CHF million

Duration less than

1 year

Duration

1 to 5 years

Duration 5 and

more years

Total

Bonds

–

124.6

–

124.6

Bank debts

13.4

44.9

–

58.3

Finance lease obligations

0.5

–

–

0.5

Other borrowings

0.1

1.4

–

1.5

Total at December 31, 2015

14.0

170.9

–

184.9

On December 14, 2012, Autoneum Holding Ltd issued a fixed-rate bond with a nominal value

of CHF 125.0 million, which is listed on the SIX Swiss Exchange (AUT12, ISIN: CH0196770439).

The bond carries a coupon rate of 4.375%, and has a term of five years with a final maturity

on December 14, 2017. On December 31, 2016, the market value of the bond was CHF 129.6 million

(2015: CHF 132.0 million).

On July 4, 2016, Autoneum Holding Ltd issued a fixed-rate bond with a nominal value of

CHF 75.0 million, which is listed on the SIX Swiss Exchange (AUH16, ISIN: CH0326213904).

The bond carries a coupon rate of 1.125%, and has a term of seven years with a final maturity on

July 4, 2023. On December 31, 2016, the market value of the bond was CHF 75.4 million.

Autoneum maintains a long-term credit agreement with a banking syndicate in the amount of

CHF 150.0 million, whereof nil was drawn at year-end (2015: CHF 40.0 million). The line of credit may

partly be used as a guarantee facility. The final maturity date is December 31, 2019. The interest

rate is based on the LIBOR rate plus an applicable margin, which is determined based on the ratio of

net debt to EBITDA. The credit agreement contains customary financial covenants, which include

the ratio of net debt to EBITDA and a minimum economic equity. Compliance with financial covenants

is checked quarterly and reported to the banking syndicate. In fiscal years 2016 and 2015, the

financial covenants were met at all times.

In addition to the aforementioned bonds and the long-term credit agreement, local credit limits

and borrowings with individual customary market conditions exist in several countries.

100

Autoneum

Financial Report 2016

Consolidated Financial Statements