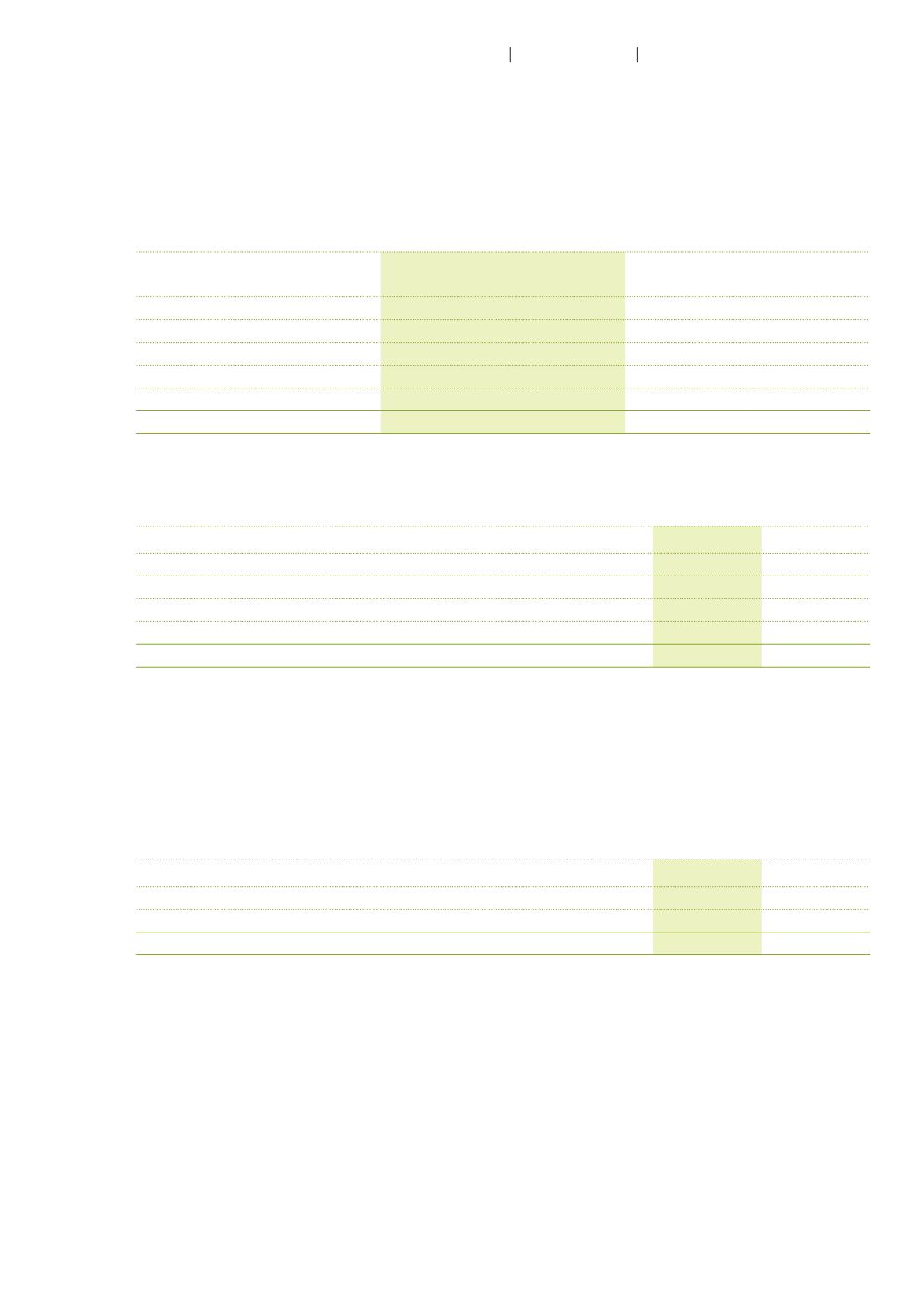

The table below sets forth the aging of trade receivables and the allowance for doubtful trade

receivables, showing amounts that are not yet due as well as an analysis of overdue amounts.

Trade receivables that are neither due nor impaired are expected to be settled within the agreed

payment terms.

CHF million

Nominal

31.12.2016

Allowance

31.12.2016

Nominal

31.12.2015

Allowance

31.12.2015

Not due

253.6

–7.6

238.5

–9.2

Overdue 1 to 89 days

29.1

–0.8

19.4

–0.1

Overdue 90 to 179 days

1.0

–0.3

2.4

–0.1

Overdue 180 to 359 days

1.0

–0.3

3.9

–0.2

Thereafter

1.7

–1.4

0.5

–0.2

Total

286.4

–10.3

264.7

–9.8

Trade receivables comprise receivables due from customers with the following credit rating

(Standard & Poor’s long-term issuer rating):

CHF million

31.12.2016 31.12.2015

A– or higher

76.4

72.4

BBB– to BBB+

101.5

89.3

BB+ or lower

87.1

84.3

Not rated

11.1

8.8

Total

276.1

254.9

At December 31, 2016, no trade receivables are pledged as security for financial liabilities (2015:

CHF 0.9 million). Trade receivables with a book value of CHF 0.5 million (2015: CHF 2.5 million) were

sold to third parties based on factoring agreements and no material risks remain with Autoneum.

20 Cash and cash equivalents

CHF million

31.12.2016 31.12.2015

Cash at banks

148.6

77.1

Time deposits with original maturities up to 3 months

1.2

1.6

Total

149.8

78.7

95

Autoneum

Financial Report 2016

Consolidated Financial Statements