3 Change in scope of consolidation and significant transactions

Autoneum’s US subsidiary UGN Inc. sold its business in Chicago Heights (Illinois), USA, to an affiliate

of Angeles Equity Partners, LLC, headquartered in Los Angeles (California), USA, on February 2, 2016.

With this transaction, UGN Inc. adjusted its product portfolio in the USA. In 2015, the business dispo-

sed of contributed third-party net sales in the amount of CHF 56.0 million.

The initial purchase price of CHF 44.7 million was received in cash at the closing date of the

transaction and the post-closing purchase price adjustment of CHF 0.4 million was settled in the

reporting period. The gain from disposal of business in the amount of CHF 33.2 million is recorded

in 2016, whereas directly attributable costs in the amount of CHF 0.3 million were recorded already

in 2015. Details of the transaction are disclosed below:

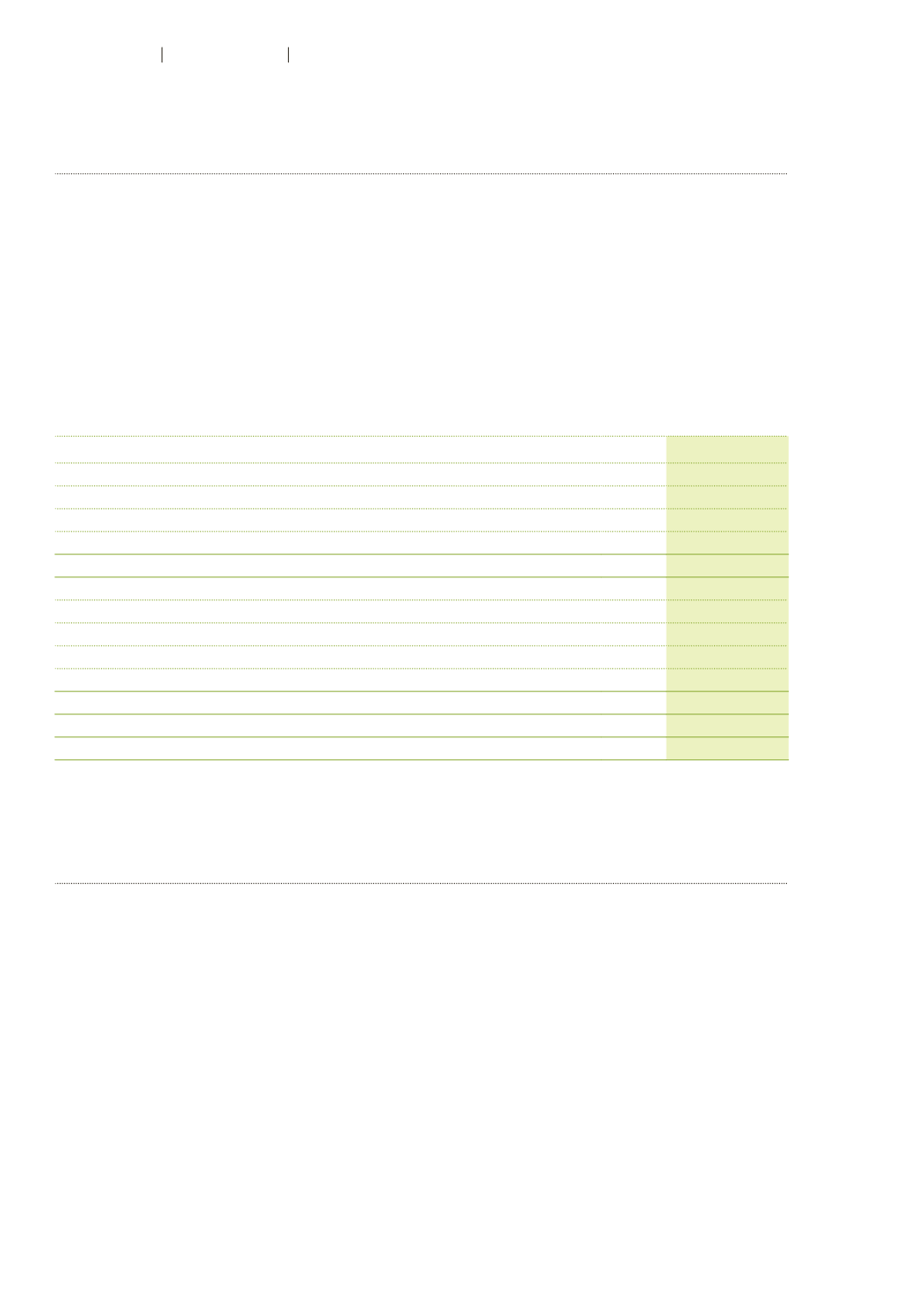

CHF million

February 2, 2016

Tangible assets

5.8

Inventories

1.2

Trade receivables and other assets

4.0

Trade payables and other liabilities

–1.8

Net assets disposed of

9.2

Initial purchase price

44.7

Post-closing purchase price adjustment

–0.4

Net assets disposed of

–9.2

Directly attributable costs

–2.0

Gain from disposal of subsidiary or business

33.2

Proceeds from disposal of subsidiary or business

42.4

In 2016, the company Autoneum (Shanghai) Management Co. Ltd., Shanghai, China was established.

4 Segment information

Segment information is based on Autoneum Group’s internal organization and management structure

as well as on the internal financial reporting to the Group Executive Board and the Board of Directors.

Chief operating decision maker is the CEO.

Autoneum is the globally leading automobile supplier in acoustic and thermal management for

vehicles. Autoneum develops and produces multifunctional and lightweight components and systems for

noise and heat protection and thereby enhances vehicle comfort.

The reporting is based on the following four reportable segments (Business Groups): BG Europe,

BG North America, BG Asia and BG SAMEA (South America, Middle East and Africa). Corporate

and elimination include Autoneum Holding Ltd and the corporate center with its respective legal

entities, an operation that produces parts for Autoneum’s manufacturing lines, investments in

associates, and inter-segment elimination. Transactions between the Business Groups are made on

the same basis as with independent third parties.

84

Autoneum

Financial Report 2016

Consolidated Financial Statements