if the beneficiaries are then still employed by an Autoneum company. Immediate vesting occurs in case

of death or retirement of the beneficiary. In case of employment termination, shares not yet vested

lapse without compensation. Exceptions are possible at the discretion of the Nomination and Compen-

sation Committee. The first vesting date was in spring 2015. Employee expenses resulting from

share-based compensation in course of the LTI are recognized over the vesting period. 4 109 shares

(2015: 3 783 shares) valued at CHF 224.50 (2015: CHF 213.60) were granted in 2016, and expenses

of CHF 0.8 million (2015: CHF 0.6 million) were recognized in wages and salaries.

Members of the Board of Directors receive part of their remuneration in Autoneum shares.

2 848 shares (2015: 3 311 shares) valued at CHF 198.04 (2015: CHF 182.84) were granted in 2016,

and expenses of CHF 0.6 million (2015: CHF 0.6 million) were recognized in wages and salaries.

Members of the Group Executive Board receive part of their remuneration in Autoneum

shares. 5 801 shares (2015: 6 423 shares) valued at a weighted average share price of CHF 266.30

(2015: CHF 191.60) were granted in 2016, and expenses of CHF 1.5 million (2015: CHF 1.2 million)

were recognized in wages and salaries.

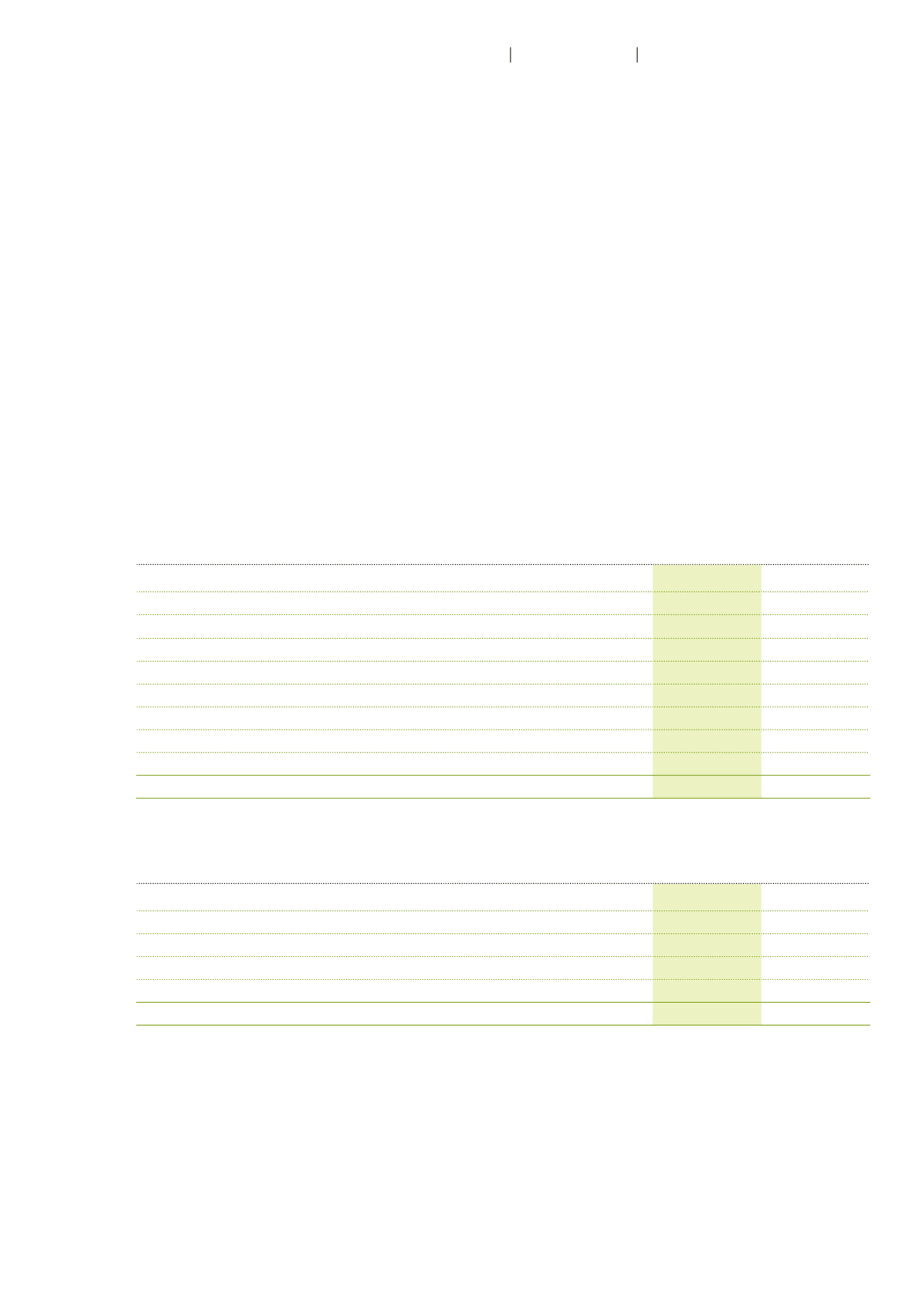

6 Other expenses

CHF million

2016

2015

Energy, maintenance and repairs

156.6

148.8

Marketing and distribution costs

55.7

63.0

Operating leasing expenses

37.9

32.6

Audit and consulting expenses

22.5

20.9

IT and office expenses

20.1

16.9

Insurance and other charges

13.9

16.3

Settlement with the German Federal Cartel Office

–

31.5

Miscellaneous expenses

45.8

36.5

Total

352.6

366.6

7 Other income

CHF million

2016

2015

Gain from disposal of subsidiary or business

33.2

–

Gain from disposal of tangible assets

2.9

–

Rental income

1.1

0.8

Miscellaneous income

14.6

14.7

Total

51.8

15.5

Miscellaneous income contains mainly income generated with by-products arising during the

manufacturing process.

87

Autoneum

Financial Report 2016

Consolidated Financial Statements