The increase in the net deferred income tax assets by CHF 3.5 million (2015: decrease by CHF 1.1 mil-

lion) relates to the deferred income tax income recognized in the consolidated income statement

of CHF 2.9 million (2015: deferred income tax expense of CHF 0.8 million), to the deferred income tax

income recognized in other comprehensive income of CHF 1.0 million (2015: income tax income of

CHF 0.7 million) and to a currency translation adjustment of CHF –0.4 million (2015: CHF –1.0 million).

No deferred income tax assets have been recognized from deductible temporary differences in the

amount of CHF 66.4 million (2015: CHF 101.0 million). At the reporting date, no tax loss carry-

forwards (2015: 0.2 million) are recognized for Group companies that incurred losses in 2016 or 2015

(2015 or 2014) supported by increased future profitability and synergies as a result of restructuring.

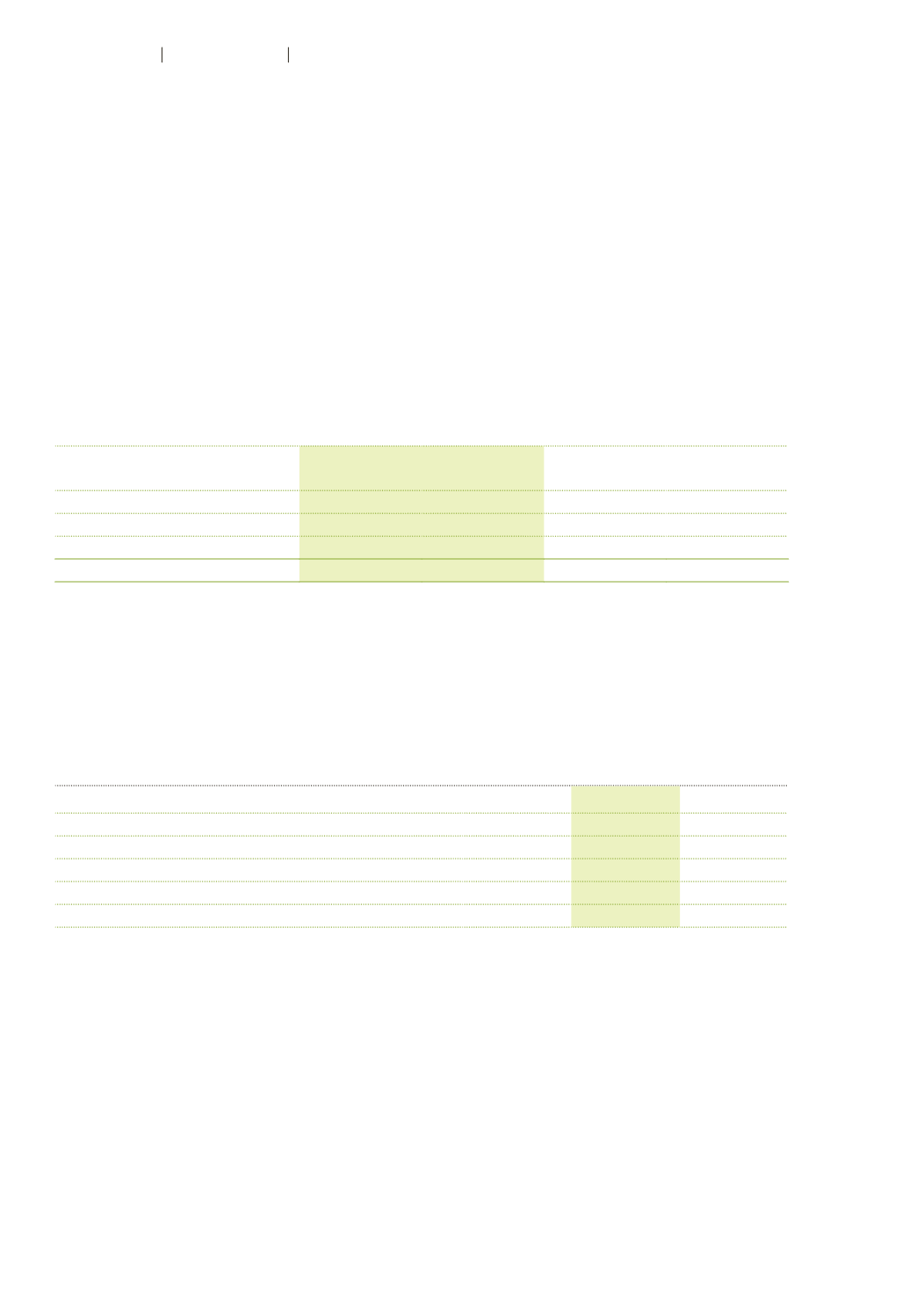

The table below discloses tax loss carryforwards and tax credits by their year of expiry:

CHF million

Recognized

1

31.12.2016

Non-recognized

2

31.12.2016

Recognized

1

31.12.2015

Non-recognized

2

31.12.2015

Less than 3 years

–

1.6

0.3

2.8

In 3 to 7 years

9.1

8.4

8.7

19.4

Thereafter

57.3

289.2

66.9

300.3

Total

66.5

299.2

75.9

322.5

1

Tax loss carry forwards and tax credits for which deferred income tax assets were recognized.

2

Tax loss carry forwards and tax credits for which no deferred income tax assets were recognized.

The tax loss carryforwards for which no deferred income tax assets were recognized originate from

countries with a deferred income tax rate between 17% and 35% (2015: between 18% and 35%).

12 Earnings per share

2016

2015

Profit attributable to shareholders of Autoneum Holding Ltd

1

CHF million

95.8

42.2

Average number of shares outstanding

Number of shares

4 648 581

4 627 120

Average number of shares outstanding diluted

Number of shares

4 654 735

4 637 259

Basic earnings per share

CHF

20.61

9.12

Diluted earnings per share

CHF

20.58

9.10

1

The LTI does not lead to a dilution effect in profit attributable to shareholders of Autoneum Holding Ltd.

The average number of shares outstanding is calculated based on the number of shares issued less

the weighted average number of treasury shares held. The consideration of shares granted but

not yet vested in the course of the management’s long-term incentive plan (LTI) leads to a diluted

average number of shares outstanding.

90

Autoneum

Financial Report 2016

Consolidated Financial Statements